Starting off with Comparing Home and Auto Insurance Bundles: Are They Worth It?, this introductory paragraph aims to grab the attention of readers and provide a brief overview of the topic.

The following paragraph will delve into the specifics and details of the subject matter.

Introduction to Home and Auto Insurance Bundles

Home and auto insurance bundles refer to the practice of purchasing both home insurance and auto insurance from the same provider. This allows policyholders to combine their coverage for both their home and vehicles into a single package.

By bundling home and auto insurance, policyholders can benefit from a range of advantages. Firstly, it simplifies the insurance process by having all policies with one provider, making it easier to manage and keep track of coverage. Additionally, bundling can lead to potential cost savings for policyholders.

Cost Savings

One of the key benefits of bundling home and auto insurance is the potential cost savings it can offer. Insurance providers often offer discounts to policyholders who bundle multiple policies with them. These discounts can help reduce the overall insurance premiums, resulting in savings for the policyholder.

Coverage Offered in Home and Auto Insurance Bundles

When you opt for a home and auto insurance bundle, you can expect comprehensive coverage that combines protections for your home and vehicles under a single policy. This can not only simplify your insurance management but also potentially save you money in the long run.

Types of Coverage Included in Bundles

- Property Coverage: This includes protection for your home and belongings, as well as your vehicles against damages caused by covered perils like fire, theft, vandalism, and natural disasters.

- Liability Coverage: Bundled policies typically offer liability coverage for both your home and auto, protecting you financially in case you are responsible for injuries or damages to others.

- Personal Injury Protection: Some bundles may also include coverage for medical expenses related to injuries sustained in a car accident or on your property.

- Rental Reimbursement: In the event of a covered loss, bundled policies may provide rental car reimbursement or temporary accommodation coverage.

Advantages of Bundled Coverage

- Cost Savings: Bundling your home and auto insurance can often lead to discounts on your premiums, resulting in overall cost savings compared to purchasing separate policies.

- Simplified Claims Process: With a bundled policy, you deal with a single insurance provider for all your claims, making the process more streamlined and convenient.

- Consistent Coverage: Bundled policies ensure that your home and auto coverage are aligned, minimizing the risk of coverage gaps or overlaps.

Comparison with Standalone Policies

- Customization: While standalone policies allow for more customization to suit your specific needs, bundled policies offer a convenient one-size-fits-all solution.

- Cost-effectiveness: Bundling typically results in lower premiums, but standalone policies may offer more competitive rates for individual coverage types.

- Flexibility: Standalone policies provide more flexibility to choose different insurance providers for home and auto coverage, whereas bundled policies tie you to a single insurer.

Cost Considerations and Savings

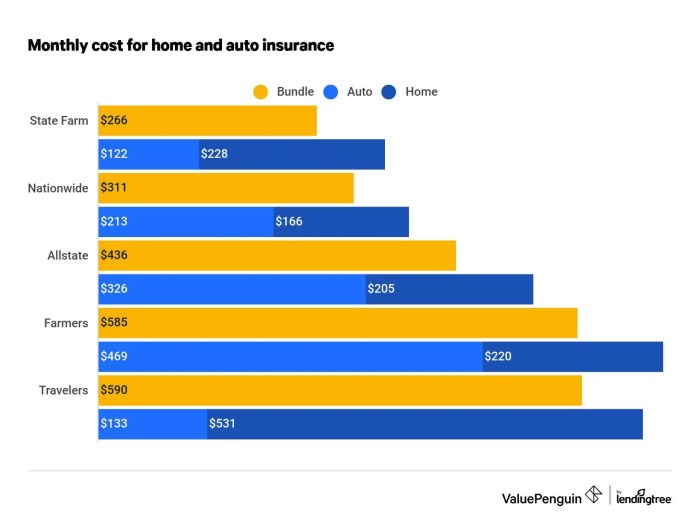

When it comes to bundling home and auto insurance, one of the key factors that attract policyholders is the potential cost savings. By combining both policies under one insurance provider, individuals can often benefit from discounts and reduced premiums.

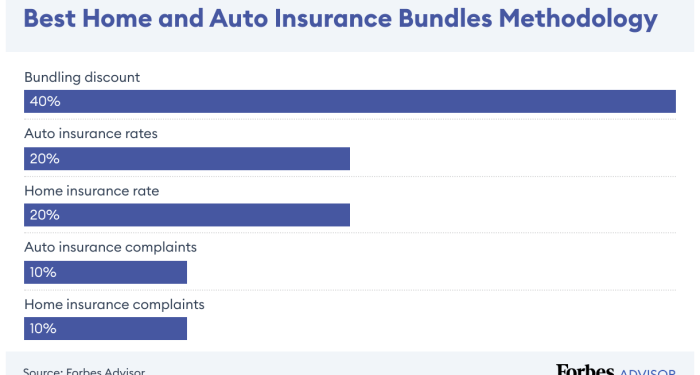

Cost Savings Associated with Bundling

- Insurance companies typically offer discounts ranging from 5% to 25% when customers bundle their home and auto insurance policies. This can result in significant savings over time.

- By consolidating policies with the same insurer, customers may also save on administrative fees and other costs associated with managing separate policies.

- Furthermore, some insurance providers offer additional perks or benefits to policyholders who choose to bundle, such as enhanced coverage options or deductible waivers.

Factors Influencing the Cost of Bundled Policies

- The overall cost of a bundled policy can be influenced by various factors, including the type of coverage selected, the value of the insured assets, the policyholder's location, driving record, credit score, and claims history.

- Newer homes, safer neighborhoods, and individuals with clean driving records are generally considered lower risk by insurers, which can lead to lower premiums for bundled policies.

- Conversely, factors like living in a high-crime area, owning a luxury vehicle, or having a history of accidents or claims may increase the cost of bundled insurance.

Maximizing Savings with Bundled Policies

- Compare quotes from multiple insurance providers to ensure you are getting the best deal on a bundled policy. Don't settle for the first offer you receive.

- Consider adjusting your coverage limits and deductibles to find a balance between cost savings and adequate protection. Higher deductibles often result in lower premiums.

- Ask about available discounts or promotions, such as multi-policy discounts, loyalty rewards, or discounts for safety features in your home or vehicle.

- Regularly review your insurance needs and update your policy accordingly to ensure you are not overpaying for coverage you no longer require.

Flexibility and Customization

When it comes to bundled home and auto insurance policies, flexibility and customization play a crucial role in ensuring that policyholders get the coverage that best suits their needs. Let's explore the options available for tailoring these bundles to fit specific requirements.

Customization Options in Home and Auto Insurance Bundles

- Policy Limits Adjustment: Policyholders can adjust the coverage limits for both home and auto insurance components within the bundle. This allows individuals to increase or decrease coverage amounts based on their assets and risk tolerance.

- Additional Coverage Add-Ons: Most insurance providers offer a range of additional coverage options that can be added to the bundle. These may include coverage for rental car reimbursement, roadside assistance, or increased liability limits.

- Deductible Choices: Policyholders often have the flexibility to choose their deductible amount for both home and auto insurance. Opting for a higher deductible can lower premium costs, while a lower deductible provides more coverage upfront.

Tailoring Coverage to Specific Needs

- Customizing for Unique Assets: Individuals with valuable assets such as jewelry, art, or collectibles may opt to add specific coverage for these items within their bundled policy.

- Personalized Discounts: Insurance companies may offer discounts for bundling home and auto insurance, as well as additional discounts for factors like home security systems, safe driving records, or multiple vehicles.

- Flexible Payment Options: Some insurers provide flexibility in payment schedules, allowing policyholders to choose monthly, quarterly, or annual payment plans based on their preferences.

Provider Options and Comparisons

When it comes to choosing an insurance provider for your home and auto insurance bundles, it's essential to compare different options to ensure you're getting the best coverage at the right price. Let's take a closer look at the key factors to consider when evaluating insurance providers.

State Farm vs. Allstate

- State Farm: Known for personalized service and a wide network of agents, State Farm offers competitive rates for bundled home and auto insurance policies. Their customer service is highly rated, making them a popular choice for many policyholders.

- Allstate: Allstate is recognized for its innovative tools and resources, such as the Drivewise program that rewards safe driving habits. They also provide a range of coverage options and discounts that can help you save on your premiums.

Geico vs. Progressive

- Geico: Geico is well-known for its affordability and user-friendly online platform, making it easy to manage your policies and file claims. They offer competitive rates for bundled insurance packages and a variety of discounts to help you save.

- Progressive: Progressive stands out for their Name Your Price tool, which allows you to customize your coverage to fit your budget. They also provide a range of discounts and perks for policyholders, along with 24/7 customer support.

Factors to Consider

- Coverage Options: Compare the types of coverage offered by each provider to ensure they meet your specific needs for both home and auto insurance.

- Pricing: Look at the overall cost of the bundled policies, including any discounts or promotions that could help you save money in the long run.

- Customer Service: Read reviews and testimonials to gauge the quality of customer service provided by each insurance company, as this can make a significant difference in your overall experience.

- Claims Process: Consider how easy and efficient the claims process is with each provider, as you'll want a smooth experience in the event of an accident or damage to your property.

Customer Satisfaction and Reviews

When it comes to bundled home and auto insurance, customer satisfaction plays a crucial role in determining the overall value of these packages. Positive experiences and feedback from policyholders can provide valuable insights into the benefits and drawbacks of opting for combined coverage.

Positive Experiences and Feedback

- Many policyholders appreciate the convenience of managing both their home and auto insurance policies under one provider. This integrated approach can streamline the process and make it easier to track and update coverage.

- Some customers have reported cost savings by bundling their home and auto insurance, thanks to discounts offered by insurance companies for combining policies. This financial benefit can be a significant factor in overall satisfaction.

- Policyholders have also highlighted the peace of mind that comes from having comprehensive coverage for both their home and vehicle. Knowing that they are protected in various scenarios can increase customer satisfaction and confidence in their insurance policies.

Common Concerns and Drawbacks

- Despite the benefits, some customers have expressed concerns about potential limitations in coverage when bundling home and auto insurance. It is essential to carefully review the policy details to ensure that all necessary protections are included.

- Policyholders may also encounter challenges in customizing their coverage to suit their specific needs and preferences. Limited flexibility in bundled packages could lead to dissatisfaction among customers who require more personalized insurance solutions.

- Issues related to claims processing and customer service quality can also impact customer satisfaction with bundled home and auto insurance. Prompt and efficient handling of claims, as well as responsive support from the insurance provider, are crucial factors for a positive experience.

Last Recap

Concluding with a summary that wraps up the discussion in a captivating manner.

FAQs

Are bundled policies more cost-effective than standalone ones?

Yes, bundling home and auto insurance typically results in cost savings compared to purchasing separate policies.

Can I customize my coverage within a bundled policy?

Yes, bundled policies often offer flexibility for customization to tailor coverage to individual needs.

How do I choose the right insurance provider for a bundled policy?

Consider factors like coverage options, pricing, and customer service when selecting an insurance provider for bundled policies.