Delving into Auto Policy Quotes vs Full Coverage: What’s the Real Difference?, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

The content of the second paragraph that provides descriptive and clear information about the topic

Understanding Auto Policy Quotes

When it comes to auto insurance, policy quotes play a crucial role in determining the cost and coverage of your insurance plan. Auto policy quotes are estimates provided by insurance companies based on various factors to determine the premium you will pay for your auto insurance coverage.

Factors Influencing Auto Policy Quotes

- Your driving record: A clean driving record with no accidents or traffic violations can result in lower policy quotes.

- Type of vehicle: The make, model, and age of your vehicle can impact the cost of your insurance premium.

- Location: Where you live and where you park your car can influence your policy quotes due to factors like crime rates and traffic congestion.

- Coverage options: The type and amount of coverage you choose will also affect your policy quotes.

Types of Auto Policy Quotes

- Basic Liability: This type of policy quote covers damages you cause to others in an accident, but not damage to your own vehicle.

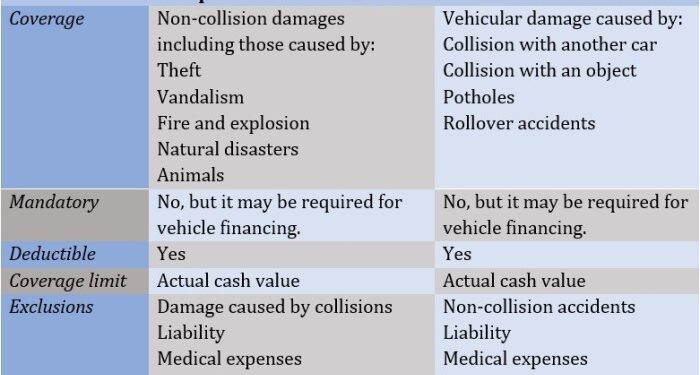

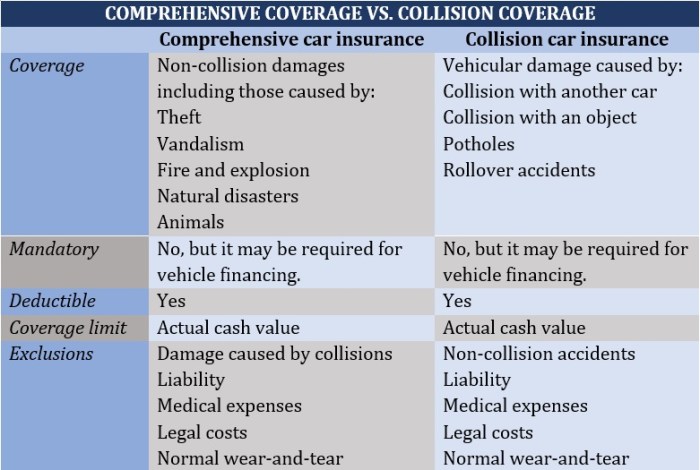

- Collision Coverage: Offers protection for damages to your own vehicle in a collision with another vehicle or object.

- Comprehensive Coverage: Provides coverage for damages to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

Obtaining Auto Policy Quotes

Obtaining auto policy quotes is a straightforward process. You can request quotes online through insurance company websites by providing necessary information about yourself, your vehicle, and your coverage preferences. Alternatively, you can contact insurance agents directly to get personalized quotes based on your specific needs.

Exploring Full Coverage Insurance

Full coverage insurance is a comprehensive auto insurance policy that includes a combination of coverage types to provide a higher level of protection for your vehicle.

Components of Full Coverage Insurance

- Liability Coverage: Protects you if you are at fault in an accident and covers the other party's medical expenses and property damage.

- Collision Coverage: Pays for repairs to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: Covers damages to your car from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you are in an accident with a driver who has insufficient or no insurance.

Benefits of Full Coverage Insurance

- Peace of Mind: Full coverage insurance provides extensive protection for your vehicle, giving you peace of mind on the road.

- Financial Security: In the event of an accident or unforeseen incident, full coverage insurance can help cover costly repairs or replacements.

- Additional Coverage: Full coverage insurance offers a wide range of coverage options to suit different needs and circumstances.

Common Misconceptions about Full Coverage Insurance

- Full coverage insurance is too expensive for most drivers, but it can actually save you money in the long run by covering costly repairs.

- Some drivers believe that full coverage insurance is unnecessary if they have an older vehicle, but it can still be beneficial for protecting your investment.

- There is a misconception that full coverage insurance covers everything, but it's important to understand the specific inclusions and exclusions of your policy.

Differentiating Auto Policy Quotes and Full Coverage

When comparing auto policy quotes and full coverage insurance, it is essential to understand the key differences between the two options. Auto policy quotes typically refer to the basic level of coverage required by law, while full coverage insurance offers a more comprehensive level of protection for your vehicle.

Coverage Levels

- Auto Policy Quotes:

- Basic liability coverage for bodily injury and property damage

- May not cover damage to your own vehicle

- Usually the minimum required by law

- Full Coverage Insurance:

- Includes liability coverage as well as collision and comprehensive coverage

- Protects your vehicle from a wider range of risks, such as theft, vandalism, and natural disasters

- Offers more financial protection in case of accidents or damages

Premium Variations

- Auto Policy Quotes:

- Generally lower premiums due to limited coverage

- May vary based on factors such as age, driving record, and location

- Full Coverage Insurance:

- Higher premiums to reflect the increased coverage and protection

- Costs may be influenced by the value of your vehicle and deductible choices

Implications of Choosing

Choosing auto policy quotes over full coverage insurance can result in cost savings in the short term but may leave you financially vulnerable in case of accidents or damages to your own vehicle. On the other hand, opting for full coverage insurance provides more comprehensive protection but comes with higher premiums.

It is important to weigh the risks and benefits of each option based on your individual needs and financial situation.

Factors to Consider When Choosing Between Auto Policy Quotes and Full Coverage

When deciding between auto policy quotes and full coverage insurance, there are several key factors to take into consideration. These factors can vary from personal preferences to financial constraints, all of which play a crucial role in determining the most suitable option for your insurance needs.

Personal Factors Influencing the Decision

- Driving Habits: Consider how often you drive, the distance you cover, and the likelihood of accidents based on your driving history.

- Vehicle Value: The age, make, and model of your car can impact the type of coverage you need. Newer or more expensive cars may benefit from full coverage.

- Personal Budget: Evaluate how much you can afford to pay for insurance premiums and how much coverage you actually need.

Financial Considerations

- Premium Costs: Compare the costs of auto policy quotes and full coverage to determine which option aligns with your budget.

- Deductibles: Understand the deductible amounts associated with each type of coverage and how they can affect your out-of-pocket expenses in the event of a claim.

- Emergency Savings: Assess your emergency fund and determine if you can cover unexpected repair costs without full coverage insurance.

Evaluating Insurance Needs

- Liability Coverage: Consider the minimum coverage required by law and whether auto policy quotes provide adequate protection in case of an accident.

- Comprehensive Coverage: Assess the need for coverage against non-collision incidents like theft, vandalism, or natural disasters, which are typically included in full coverage.

- Prior Claims History: Reflect on your past insurance claims and accidents to gauge the level of coverage you may require in the future.

Scenarios for Choosing Auto Policy Quotes or Full Coverage

- Opt for Auto Policy Quotes: If you have an older car with a low market value and can comfortably cover minor repairs out of pocket.

- Opt for Full Coverage: If you drive a new or valuable vehicle, have a history of accidents, or want comprehensive protection for various scenarios.

- Hybrid Approach: Consider combining liability coverage with some elements of full coverage to strike a balance between protection and cost.

Last Word

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Quick FAQs

What factors influence auto policy quotes?

Auto policy quotes are influenced by factors like age, driving record, type of vehicle, and location. These elements help insurance companies calculate the risk associated with insuring a driver.

What does full coverage insurance include?

Full coverage insurance typically includes liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

How do auto policy quotes differ from full coverage insurance?

Auto policy quotes are estimates for insurance premiums based on personal details, while full coverage insurance is a comprehensive policy that includes various types of coverage.

When does it make more sense to choose auto policy quotes over full coverage?

Opting for auto policy quotes might be more suitable for drivers looking to save on premiums but are willing to take on more risk in case of accidents or damages.